Did Payroll Tax Tables Change For 2022 . There are seven federal income. in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). 30 by the internal revenue service. below is an overview of the tax rates, taxable wage bases, and other updates that will impact your payroll processes when january 1 arrives. see current federal tax brackets and rates based on your income and filing status. You pay tax as a percentage of your income in. draft federal income tax withholding tables for 2022 were issued nov. washington — the internal revenue service today announced the tax year 2022 annual inflation adjustments for more. The publication contains information employers need to determine employees’.

from www.biznews.com

You pay tax as a percentage of your income in. see current federal tax brackets and rates based on your income and filing status. 30 by the internal revenue service. draft federal income tax withholding tables for 2022 were issued nov. below is an overview of the tax rates, taxable wage bases, and other updates that will impact your payroll processes when january 1 arrives. There are seven federal income. washington — the internal revenue service today announced the tax year 2022 annual inflation adjustments for more. The publication contains information employers need to determine employees’. in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

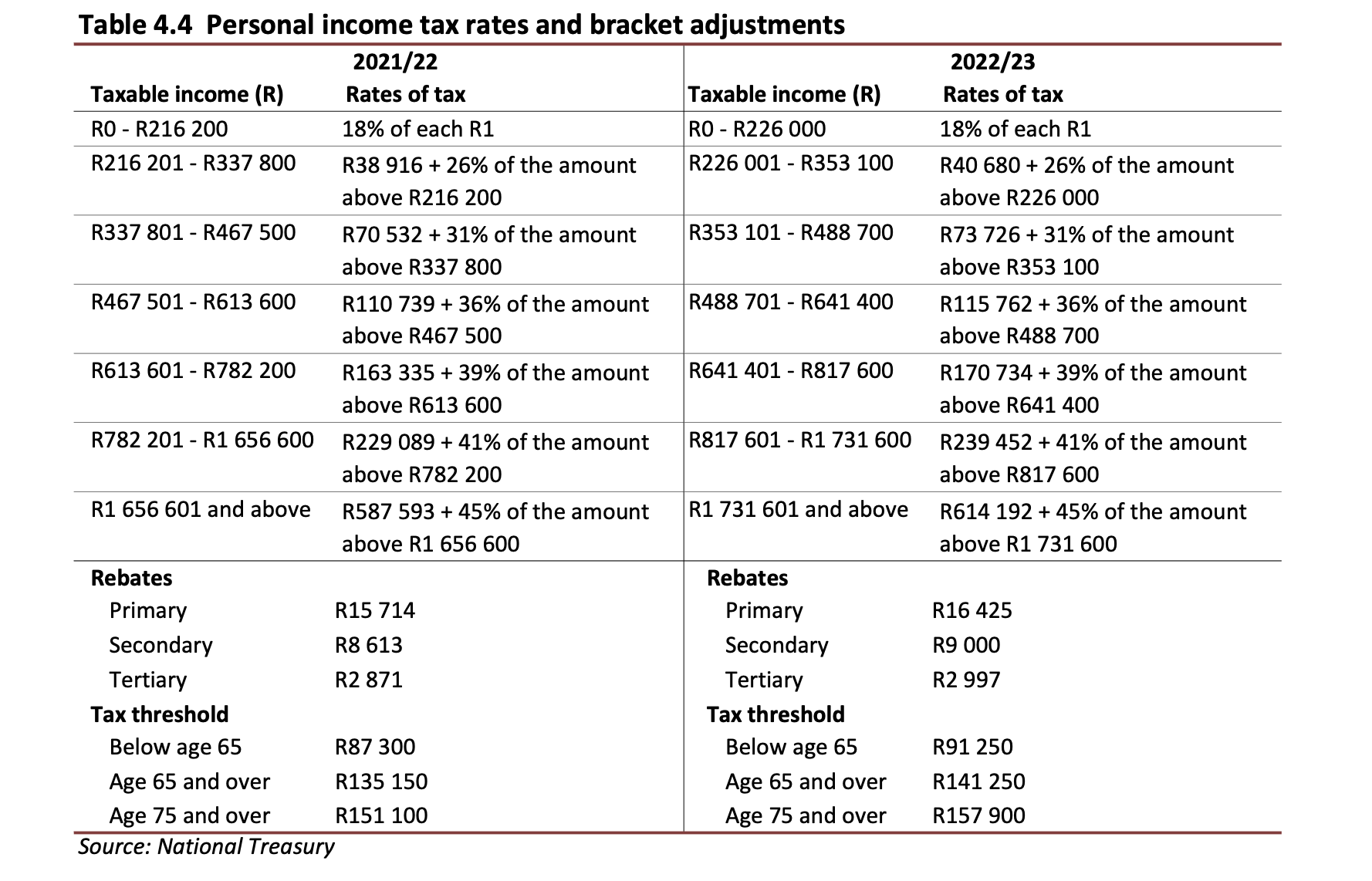

Budget 2022 The Executive Summary

Did Payroll Tax Tables Change For 2022 draft federal income tax withholding tables for 2022 were issued nov. washington — the internal revenue service today announced the tax year 2022 annual inflation adjustments for more. 30 by the internal revenue service. draft federal income tax withholding tables for 2022 were issued nov. You pay tax as a percentage of your income in. There are seven federal income. below is an overview of the tax rates, taxable wage bases, and other updates that will impact your payroll processes when january 1 arrives. see current federal tax brackets and rates based on your income and filing status. The publication contains information employers need to determine employees’. in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

From tax.modifiyegaraj.com

2022 Monthly Tax Tables TAX Did Payroll Tax Tables Change For 2022 30 by the internal revenue service. You pay tax as a percentage of your income in. draft federal income tax withholding tables for 2022 were issued nov. There are seven federal income. below is an overview of the tax rates, taxable wage bases, and other updates that will impact your payroll processes when january 1 arrives. The publication. Did Payroll Tax Tables Change For 2022.

From studylibrarygodward.z13.web.core.windows.net

Tax Tables 2022 Irs For Capital Gains Did Payroll Tax Tables Change For 2022 There are seven federal income. in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). 30 by the internal revenue service. see current federal tax brackets and rates based on your income and filing status. washington — the internal revenue service today announced. Did Payroll Tax Tables Change For 2022.

From ar.inspiredpencil.com

2022 Irs Tax Table Chart Did Payroll Tax Tables Change For 2022 draft federal income tax withholding tables for 2022 were issued nov. washington — the internal revenue service today announced the tax year 2022 annual inflation adjustments for more. The publication contains information employers need to determine employees’. There are seven federal income. see current federal tax brackets and rates based on your income and filing status. You. Did Payroll Tax Tables Change For 2022.

From printableformsfree.com

2022 Tax Rate Tables Printable Forms Free Online Did Payroll Tax Tables Change For 2022 You pay tax as a percentage of your income in. 30 by the internal revenue service. The publication contains information employers need to determine employees’. There are seven federal income. see current federal tax brackets and rates based on your income and filing status. in 2022, the income limits for all tax brackets and all filers will be. Did Payroll Tax Tables Change For 2022.

From ar.inspiredpencil.com

2022 Irs Tax Table Chart Did Payroll Tax Tables Change For 2022 The publication contains information employers need to determine employees’. in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). washington — the internal revenue service today announced the tax year 2022 annual inflation adjustments for more. see current federal tax brackets and rates. Did Payroll Tax Tables Change For 2022.

From bphwealth.co.uk

BpH Wealth Tax Tables 2022/2023 BpH Did Payroll Tax Tables Change For 2022 30 by the internal revenue service. below is an overview of the tax rates, taxable wage bases, and other updates that will impact your payroll processes when january 1 arrives. There are seven federal income. see current federal tax brackets and rates based on your income and filing status. The publication contains information employers need to determine employees’.. Did Payroll Tax Tables Change For 2022.

From blog.finapress.com

Listed here are the federal tax brackets for 2023 vs. 2022 FinaPress Did Payroll Tax Tables Change For 2022 washington — the internal revenue service today announced the tax year 2022 annual inflation adjustments for more. You pay tax as a percentage of your income in. There are seven federal income. The publication contains information employers need to determine employees’. see current federal tax brackets and rates based on your income and filing status. 30 by the. Did Payroll Tax Tables Change For 2022.

From www.etsy.com

2022 Weekly Manual Payroll Federal Tax Table Etsy Australia Did Payroll Tax Tables Change For 2022 see current federal tax brackets and rates based on your income and filing status. washington — the internal revenue service today announced the tax year 2022 annual inflation adjustments for more. There are seven federal income. You pay tax as a percentage of your income in. draft federal income tax withholding tables for 2022 were issued nov.. Did Payroll Tax Tables Change For 2022.

From ar.inspiredpencil.com

Tax Table 2022 Did Payroll Tax Tables Change For 2022 draft federal income tax withholding tables for 2022 were issued nov. below is an overview of the tax rates, taxable wage bases, and other updates that will impact your payroll processes when january 1 arrives. There are seven federal income. in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation. Did Payroll Tax Tables Change For 2022.

From goodwille.com

Tax Table for 2022/2023 Goodwille Did Payroll Tax Tables Change For 2022 see current federal tax brackets and rates based on your income and filing status. in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). You pay tax as a percentage of your income in. below is an overview of the tax rates, taxable. Did Payroll Tax Tables Change For 2022.

From federalwithholdingtables.net

Publication 15 Tax Withholding Tables Federal Withholding Tables 2021 Did Payroll Tax Tables Change For 2022 30 by the internal revenue service. below is an overview of the tax rates, taxable wage bases, and other updates that will impact your payroll processes when january 1 arrives. draft federal income tax withholding tables for 2022 were issued nov. washington — the internal revenue service today announced the tax year 2022 annual inflation adjustments for. Did Payroll Tax Tables Change For 2022.

From projectopenletter.com

2022 Tax Tables Married Filing Jointly Printable Form, Templates and Letter Did Payroll Tax Tables Change For 2022 see current federal tax brackets and rates based on your income and filing status. draft federal income tax withholding tables for 2022 were issued nov. 30 by the internal revenue service. You pay tax as a percentage of your income in. washington — the internal revenue service today announced the tax year 2022 annual inflation adjustments for. Did Payroll Tax Tables Change For 2022.

From www.withholdingform.com

Federal Tax Withholding Forms For 2022 Did Payroll Tax Tables Change For 2022 see current federal tax brackets and rates based on your income and filing status. washington — the internal revenue service today announced the tax year 2022 annual inflation adjustments for more. The publication contains information employers need to determine employees’. below is an overview of the tax rates, taxable wage bases, and other updates that will impact. Did Payroll Tax Tables Change For 2022.

From statgeeks.weebly.com

Irs tax brackets 2022 statgeeks Did Payroll Tax Tables Change For 2022 There are seven federal income. in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). You pay tax as a percentage of your income in. The publication contains information employers need to determine employees’. see current federal tax brackets and rates based on your. Did Payroll Tax Tables Change For 2022.

From elchoroukhost.net

Federal Payroll Tax Tables Elcho Table Did Payroll Tax Tables Change For 2022 below is an overview of the tax rates, taxable wage bases, and other updates that will impact your payroll processes when january 1 arrives. There are seven federal income. in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). draft federal income tax. Did Payroll Tax Tables Change For 2022.

From www.patriotsoftware.com

2022 Tax Withholding Tables Changes & Examples Did Payroll Tax Tables Change For 2022 in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). 30 by the internal revenue service. You pay tax as a percentage of your income in. see current federal tax brackets and rates based on your income and filing status. There are seven federal. Did Payroll Tax Tables Change For 2022.

From dotnewsconnect.co.za

Budget 2022 Your Tax Tables and Tax Calculator • CA(SA)DotNews Did Payroll Tax Tables Change For 2022 see current federal tax brackets and rates based on your income and filing status. You pay tax as a percentage of your income in. in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). washington — the internal revenue service today announced the. Did Payroll Tax Tables Change For 2022.

From tradenews.us

Obtain Earnings Tax Calculator Excel 202122 [AY 202223] ★ Private Finance Did Payroll Tax Tables Change For 2022 There are seven federal income. below is an overview of the tax rates, taxable wage bases, and other updates that will impact your payroll processes when january 1 arrives. The publication contains information employers need to determine employees’. draft federal income tax withholding tables for 2022 were issued nov. 30 by the internal revenue service. You pay tax. Did Payroll Tax Tables Change For 2022.